Professional real estate appraisals play a vital role in tax matters, capital gains calculations, and probate proceedings. As a certified AACI-designated appraiser serving Muskoka, Parry Sound, and Haliburton regions, I provide comprehensive valuation services to assist with Canada Revenue Agency requirements and estate settlements

When a property owner passes away, determining the fair market value at the date of death is crucial for several reasons:

We understand the complexity of tax-related property valuations. Our appraisals are conducted according to strict professional standards, providing comprehensive reports that:

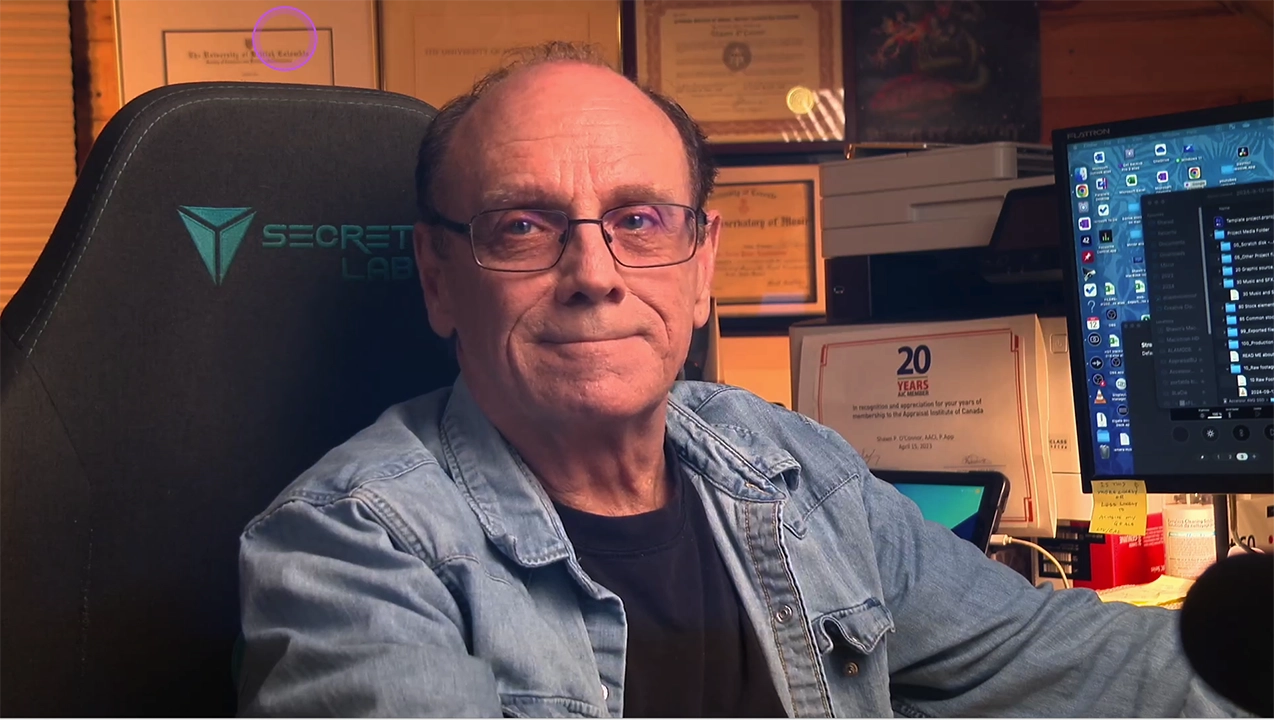

As an AACI-designated appraiser with extensive experience in tax and estate valuations, I provide reliable appraisals that meet regulatory requirements and stand up to scrutiny. Whether you need a current market value or a retrospective valuation for tax purposes, our detailed reports provide the documentation needed for CRA compliance. Contact our office to discuss your tax-related appraisal needs or to schedule a consultation.